What’s Better for Your Teen—a Credit Card or Debit Card?

By

Key Points

- Learning to use a bankcard responsibly is an important part of every young person’s financial education.

- There are pros and cons to both debit and credit cards for teens, but the most important thing is to provide guidance and boundaries to encourage responsible habits.

- It’s especially important to explain the high cost of carrying a balance on a credit card.

Dear Carrie,

My 15-year-old daughter is asking for her own credit card. While I understand that using a card is a matter of convenience, it’s also a responsibility. Is she too young? And what do you think is better for a first experience—a debit or credit card?—A Reader

Dear Reader,

With cash seemingly on the way out today, I can understand your daughter’s desire to have her own plastic. From school expenses to transportation to emergencies, having a credit  card can make her life easier—and yours, too, in terms of worrying whether she has enough cash to pay for what she needs or if cash is even accepted. But having had my own teenagers, I also understand your concern.

card can make her life easier—and yours, too, in terms of worrying whether she has enough cash to pay for what she needs or if cash is even accepted. But having had my own teenagers, I also understand your concern.

While credit cards are easy to use, they can also be costly. With the current average credit card APR at an all-time high of 17.41 percent, it’s especially important for all credit card users to use a bankcard responsibly. You might be surprised to know that, according to a 2017 Parents, Kids and Money Survey conducted by T. Rowe Price, 18 percent of 8 to 14 year olds have access to some type of credit card.

That may seem a bit young (it does to me), but I think that for many teens, 15 is a perfectly reasonable age to get some hands-on experience. And regardless of the child’s age, the key is to provide enough guidance and boundaries to help your kids learn to use plastic wisely. So on top of choosing between debit or credit, it’s important to have some serious discussions about what using any type of bankcard really means.

The case for a debit card and what it teaches

I like the idea of helping your teen open a checking account with an attached debit card as a first experience for a couple of reasons. First, while it offers the convenience of paying with a card and accessing cash at an ATM, the teen is spending their own money, not borrowing. On top of that, this combination teaches a young person how to track spending, get familiar with writing checks and keeping a check register, and using online banking to stay on top of their money.

But before you hand over any type of bankcard, make sure your daughter understands not only how the card works, but also the costs—monthly fees and especially overdraft fees and how they can add up. There are several banks that specifically offer “teen” accounts. You might have her research the different options, and compare features and costs to find the checking account that best suits her needs. Because your daughter is under 18, you’ll have to be a joint owner on the account, but to me, that’s just fine. It will give you the chance to monitor her usage and encourage good habits.

One drawback of the checking/debit choice is that there isn’t the same fraud protection that a credit card offers. If someone hacks a credit card account, it’s the bank’s money at risk. If they hack a checking account, it’s your money (up to a certain limit) at risk. But that may be an extra incentive to keep the balance low—and to emphasize to your daughter the importance of protecting her card and information.

Another option is to get a prepaid debit card on which you load a specific dollar amount, similar to a gift card. This would provide the convenience of paying with plastic while

setting a strict limit to the amount your daughter could spend. However, it wouldn’t offer the same type of banking/money management lesson. In addition, there are often fees associated with these cards, and there is no protection for a lost card.

Getting the right start with credit

When you think your daughter is responsible enough to have a credit card, there are a couple of ways to go. My first choice would be to make her an authorized user on your own credit card. This would let you monitor her activity and help her learn to use credit wisely before she actually has a card of her own (which she legally can’t have until she’s 21 without verified income or a co-signer). And even though you’re the primary cardholder, as an authorized user she’ll begin to build her own credit history. On the flip side, though, if your daughter misuses the card, you are liable for her charges and also put your own credit rating at risk.

credit card. This would let you monitor her activity and help her learn to use credit wisely before she actually has a card of her own (which she legally can’t have until she’s 21 without verified income or a co-signer). And even though you’re the primary cardholder, as an authorized user she’ll begin to build her own credit history. On the flip side, though, if your daughter misuses the card, you are liable for her charges and also put your own credit rating at risk.

Another option is a secured credit card. This type of card requires a security deposit, which typically acts as the line of credit, allowing you to easily set limits right away on the amount she can charge. The credit line is a percentage of the deposit; for example, it might be 50 to 100 percent of a $1,000 deposit. A benefit is that a secured card will allow your daughter to build a credit history (unlike a debit card).

But whatever type of card you choose, the most important thing is to talk to your daughter about what having a credit card means beyond a convenient way to pay. Make sure she understands the details of fees, possible perks, and interest rates and how they add up. Emphasize how misuse can impact her credit rating and affect her future ability to borrow money, rent an apartment, buy a car or even get a job.

Ideally, make your daughter responsible for paying her own balance. For an eye-opening lesson, go through a couple of scenarios on a cost-of-debt calculator. For instance, if you carry a $1,000 balance at 18 percent APR and only pay the monthly minimum, it will take 113 months to pay it off and you’ll pay $923 in interest! A rule-of-thumb for your daughter: When it comes to credit card debt, the best balance to carry over into the next month is $0.

Putting debt in perspective

Make sure your daughter understands that not all debt is bad. Some debt, like a mortgage, can actually work for you. Carrying a credit card balance can really trip you up. Here’s another eye-opener: According to a recent study, outstanding credit card debt in the U.S.  is $1.03 trillion dollars and, in 2018 alone, Americans paid banks $104 billion in interest and fees. If you give your daughter a good credit start now, hopefully she won’t be adding to that statistic in years to come.

is $1.03 trillion dollars and, in 2018 alone, Americans paid banks $104 billion in interest and fees. If you give your daughter a good credit start now, hopefully she won’t be adding to that statistic in years to come.

The Publishers of ALPHA-PHONICS, and of the ALPHA-PHONICS BLOG, feel this article could be helpful to parents considering allowing their children to have their own credit card. It also should be very helpful to their children.

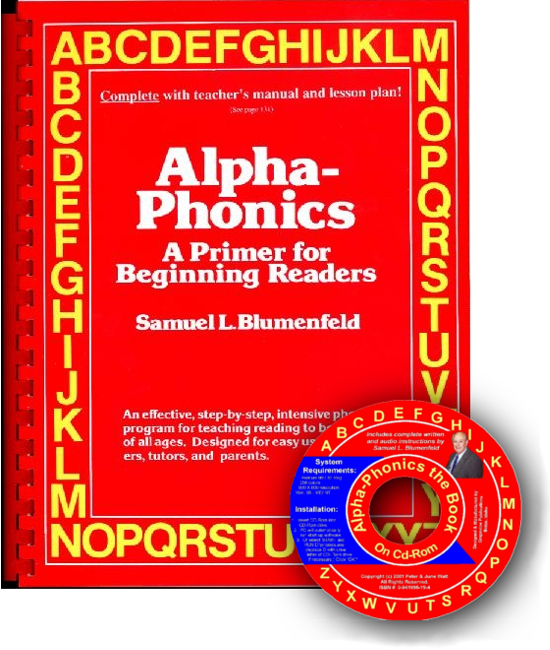

ALPHA-PHONICS A PRIMER FOR BEGINNING READERS is also a very helpful resource for parents to use with their younger children to teach them how to read…..using good old-fashioned systematic PHONICS.

Here are the why’s and wherefores:

WEBSITE TESTIMONIALS REVIEWS HOW TO ORDER

A DAD WHO TAUGHT HIS YOUNG SON TO READ WITH ALPHA-PHONICS TELLS HOW IT WORKED FOR THEM:

Alpha-Phonics

Alpha-Phonics The Alphabet Song!

The Alphabet Song! Water on the Floor

Water on the Floor Alpha-Phonics the Book on CD Rom

Alpha-Phonics the Book on CD Rom Blumenfeld Oral Reading Assessment Test

Blumenfeld Oral Reading Assessment Test How To Tutor

How To Tutor How To Tutor Cursive Handwriting Workbook

How To Tutor Cursive Handwriting Workbook